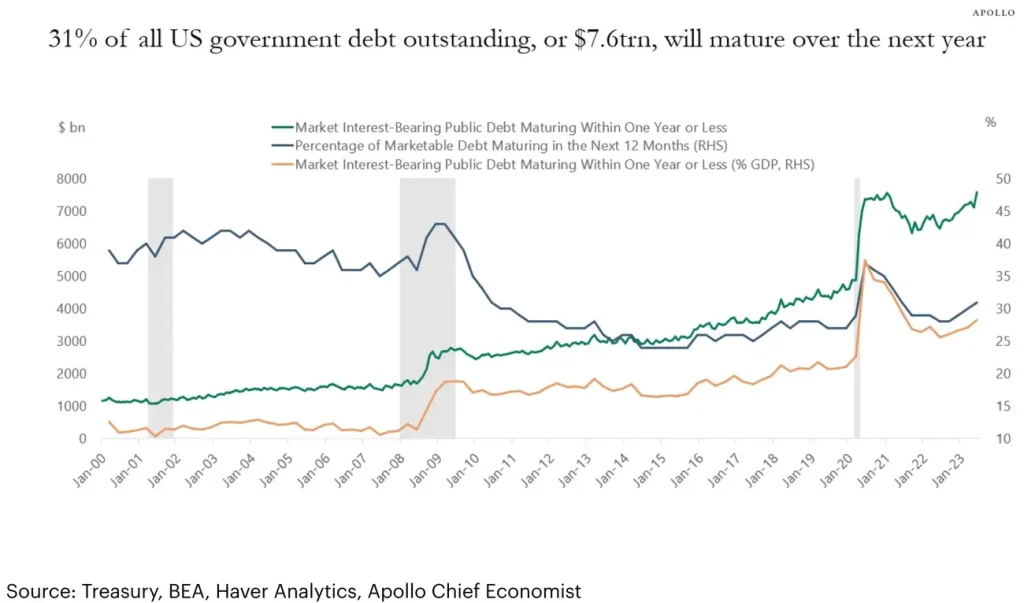

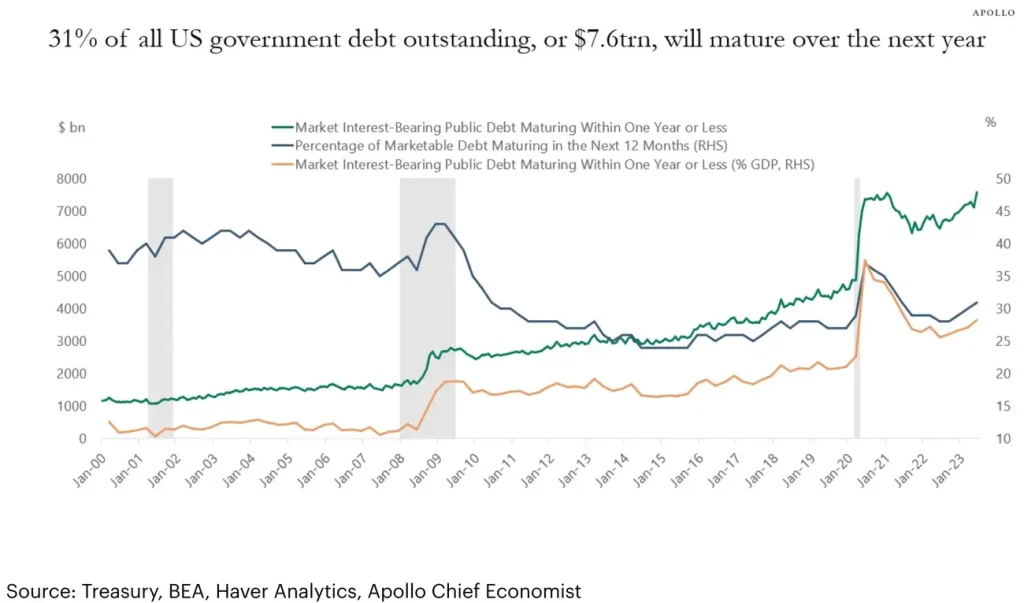

According to an analysis by asset management firm Apollo, approximately one-third of all outstanding US government debt is scheduled to mature within the next 12 months. This amounts to $7.6 trillion, a level not seen since early 2021, and represents over a quarter of US GDP. While this figure is below its peak in 2020, it still exerts upward pressure on US interest rates. The rise in short-term debt maturity comes as federal deficits have increased in recent years, leading to a higher trajectory of US debt. Despite the Federal Reserve’s quantitative tightening program and higher borrowing costs, the Treasury Department has already auctioned $1 trillion in bonds this quarter.

As of the latest data, the 10-year Treasury yield stands at 4.25%, with the three-month yield at 5.47%. While the overall impact of quantitative tightening has been limited so far, a recent St. Louis Fed research paper suggests that participation by money market funds in T-bill auctions has started to level off, potentially affecting the demand for US government debt.

This situation highlights the ongoing challenges and complexities of managing the US government’s debt levels and servicing costs in a rapidly changing economic environment.